The world of decentralized finance (DeFi) continues to evolve at a breathtaking pace, constantly introducing innovative protocols designed to reshape traditional financial paradigms. Among these, Ethena has emerged as a significant player, particularly with its novel approach to creating a synthetic dollar, USDe, and a yield-bearing version, sUSDe. As of June 11, 2025, the cryptocurrency market remains a dynamic landscape, influenced by a confluence of macroeconomic factors, technological advancements, and shifting investor sentiment. For those tracking the burgeoning synthetic asset sector, Ethena’s performance and future trajectory are subjects of considerable interest. This article delves into a comprehensive price prediction for Ethena (ENA), analyzing its historical performance, identifying key drivers of its value, and presenting both short-term and long-term forecasts based on an advanced algorithmic model. Understanding these dynamics is crucial for investors aiming to navigate the complexities of digital asset investments.

Understanding Ethena: A New Paradigm for Synthetic Dollars

Ethena is a synthetic dollar protocol built on Ethereum, aiming to provide a crypto-native, scalable synthetic dollar called USDe. Unlike traditional stablecoins pegged to fiat currencies through reserves, USDe achieves its peg and scalability through a delta-neutral hedging strategy. This innovative mechanism involves using staked Ethereum (stETH) as collateral and simultaneously shorting Ethereum derivatives to maintain a ‘delta-neutral’ position. This means the protocol aims to be indifferent to price movements of its underlying collateral, thereby providing a stable value for USDe.

The protocol also offers a yield-bearing derivative of USDe, known as sUSDe, which allows holders to earn returns generated from Ethena’s hedging operations and staked Ethereum rewards. This unique blend of stability, scalability, and yield generation positions Ethena as a compelling project within the DeFi ecosystem, attracting attention from both individual investors and institutional participants.

How Ethena’s Synthetic Dollar Mechanism Works

At its core, Ethena’s operational model revolves around two primary components: the collateralized asset and the hedging mechanism. Users mint USDe by depositing assets like stETH, a liquid staking derivative of Ethereum. To maintain the peg and offset the price volatility of the deposited collateral, Ethena simultaneously opens short positions on Ethereum perpetual swaps and futures across various centralized and decentralized exchanges. This ‘delta-neutral’ strategy is paramount to USDe’s stability. If the price of Ethereum increases, the value of the stETH collateral rises, but the short position loses money, theoretically balancing each other out. Conversely, if Ethereum’s price drops, the stETH collateral decreases in value, but the short position profits, again maintaining a stable net value.

The yield generated by sUSDe originates from two main sources: the staking rewards from the underlying stETH collateral and the funding rates received from the short perpetual positions. These funding rates can fluctuate significantly, impacting the yield offered by sUSDe. When funding rates are positive, the short positions pay out, contributing to the yield. When funding rates are negative, Ethena must pay, which can reduce or even negate the yield. This intricate balancing act is what defines Ethena’s approach to synthetic dollar creation, making it a sophisticated yet potentially rewarding asset within the DeFi space.

The ENA Token Utility

Beyond USDe and sUSDe, Ethena also features its native governance token, ENA. The ENA token plays a crucial role in the decentralized governance of the Ethena protocol. Holders of ENA have the ability to propose and vote on key decisions related to the protocol’s future development, risk parameters, fee structures, and the management of the protocol’s treasury. This grants token holders a direct stake in the evolution and direction of Ethena, ensuring that the protocol remains aligned with the interests of its community. The utility of ENA is deeply intertwined with the success and adoption of USDe, as a thriving ecosystem built around the synthetic dollar would naturally enhance the value proposition of the governance token. As the protocol grows, the importance of ENA holders in shaping its future will likely become even more pronounced, making it an essential component of Ethena’s decentralized infrastructure.

Historical Price Performance of Ethena (ENA)

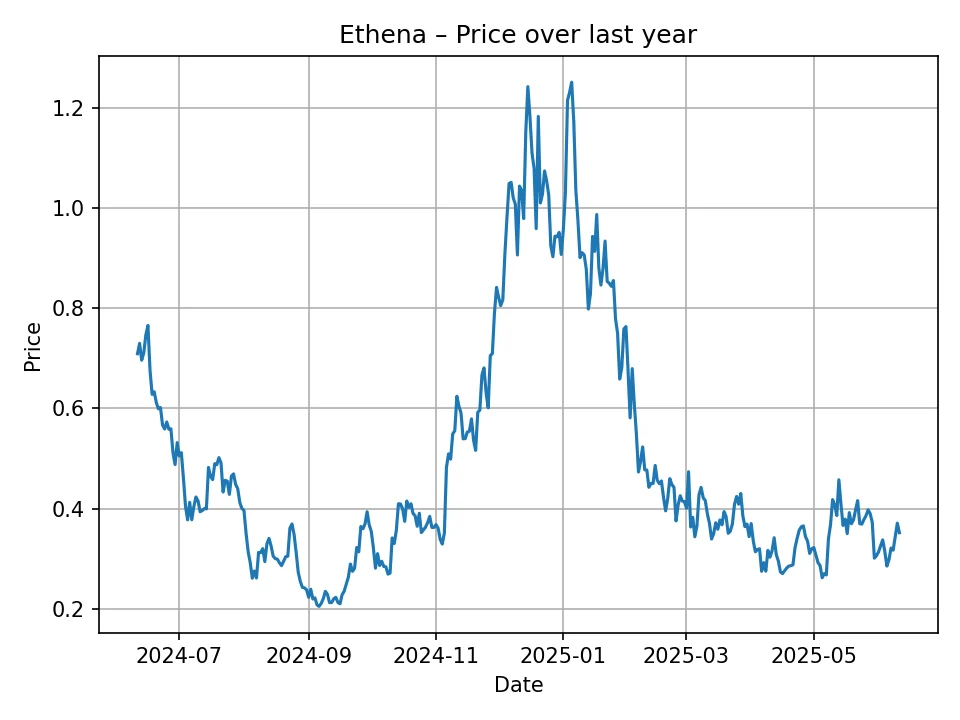

Analyzing Ethena’s historical price data for the past 12 months reveals a journey marked by significant volatility and periods of both rapid growth and consolidation. The provided daily data points, ranging from approximately 0.20 USD to over 1.20 USD, paint a picture of a relatively new asset navigating the turbulent waters of the cryptocurrency market. Initially, ENA experienced considerable price discovery, characteristic of many newly launched tokens. We observe a starting point around 0.70 USD, followed by a decline to lows near 0.20-0.30 USD. This initial correction is not uncommon, as early speculative interest often gives way to market recalibration.

Subsequently, ENA demonstrated resilience, embarking on an upward trend, particularly notable for its surges to peaks above 1.00 USD. These periods of appreciation could be attributed to increasing awareness of the Ethena protocol, positive market sentiment, or specific milestones achieved by the project. However, these highs were often followed by pullbacks, reflecting the inherent volatility of the crypto space and profit-taking by early investors. The asset has shown a capability to recover from downturns, suggesting underlying demand and interest in the protocol’s utility. The most recent price point in the historical data stands at approximately 0.35 USD, indicating that ENA has undergone a significant correction from its earlier highs and is currently trading at a lower range within its 12-month history. This specific price reflects the market’s current valuation, taking into account recent market dynamics and the protocol’s performance.

Key Factors Influencing Ethena’s Price

The price of Ethena’s ENA token is subject to a multitude of factors, typical of any digital asset, but also unique to its specific niche within synthetic assets and DeFi. Understanding these influences is crucial for forming an informed perspective on its future price movements.

Macroeconomic Environment and Crypto Market Trends

The broader macroeconomic climate, including global interest rates, inflation, and geopolitical stability, significantly impacts investor appetite for risk assets like cryptocurrencies. A bullish Bitcoin (BTC) and Ethereum (ETH) market often creates a positive ripple effect, lifting altcoins like ENA. Conversely, downturns in major cryptocurrencies can exert downward pressure across the board. Ethena, being built on Ethereum, is particularly sensitive to Ethereum’s ecosystem health and overall DeFi sentiment.

Protocol Development and Adoption

The continued development and successful implementation of Ethena’s roadmap are paramount. This includes upgrades to the USDe synthetic dollar, improvements in the delta-neutral hedging strategy, and expansion into new chains or DeFi protocols. Increased adoption of USDe as a stablecoin alternative across various applications, decentralized exchanges (DEXs), and lending platforms would directly enhance ENA’s utility and perceived value. Partnerships with other DeFi projects or integrations into mainstream financial systems could also act as significant catalysts.

USDe Yield and Funding Rates

The attractiveness and sustainability of the yield offered by sUSDe are critical. If funding rates on perpetual futures markets turn persistently negative, it could diminish the yield, potentially reducing demand for USDe and sUSDe. This would, in turn, affect the broader perception of the Ethena ecosystem and indirectly impact the ENA token price. Conversely, consistently high and stable positive funding rates would reinforce Ethena’s value proposition.

Regulatory Scrutiny

The regulatory landscape for stablecoins and synthetic assets is still evolving. Any adverse regulatory actions or increased scrutiny on protocols like Ethena could introduce uncertainty and negatively impact investor confidence. Conversely, clear and favorable regulatory frameworks could foster greater institutional adoption and stability.

Competition

Ethena operates in a competitive landscape with other stablecoins (USDT, USDC, DAI) and emerging synthetic asset protocols. Its ability to differentiate itself through innovation, security, and sustained yield will be crucial for maintaining and growing its market share.

Security and Smart Contract Risk

Given Ethena’s reliance on complex smart contracts and interactions with various DeFi primitives, security remains a paramount concern. Despite rigorous audits, unforeseen vulnerabilities could lead to exploits, resulting in financial losses and a severe blow to the protocol’s reputation and ENA’s value. Regular audits and robust security measures are essential for long-term viability.

Liquidity and Exchange Listings

Increased liquidity on major cryptocurrency exchanges and listings on new, prominent platforms can improve ENA’s accessibility for a wider range of investors, potentially driving up demand and price.

Ethena (ENA) Price Prediction Methodology

Forecasting cryptocurrency prices is inherently challenging due to the volatile and speculative nature of the market. Numerous factors, ranging from technological advancements and regulatory shifts to macroeconomic conditions and social sentiment, can influence price movements. Our price predictions for Ethena (ENA) are generated using a proprietary algorithmic model, EdgePredict, which analyzes historical price data, identifies trends, and attempts to project future performance based on complex mathematical patterns. While these algorithms provide a data-driven outlook, it is crucial to remember that they are based on past performance and statistical probabilities, not guarantees. The crypto market is known for its unpredictability, and unexpected events can significantly alter even the most sophisticated predictions. Therefore, these forecasts should be viewed as probabilities within a range of potential outcomes, rather than definitive future prices. Investors are always advised to conduct thorough due diligence and consider various sources of information before making any investment decisions.

Ethena (ENA) Monthly Price Forecast (July 2025 – June 2026)

Based on the EdgePredict algorithm, Ethena’s short-term price outlook for the next 12 months, from July 2025 to June 2026, suggests a period of gradual stabilization and modest growth. The forecast indicates that ENA may experience slight fluctuations but generally aims to maintain a price point above the 0.35 USD mark, hovering around the 0.35 USD to 0.40 USD range. This stability could imply that the market is finding a comfortable equilibrium for ENA after its initial volatility and recent price adjustments. The projections suggest that Ethena is anticipated to hold its ground, possibly reflecting a maturing of its core utility and a growing understanding of its value proposition within the DeFi space. Investors might view this as a period of consolidation, where ENA builds a stronger foundation before potentially attempting more significant upward movements. The monthly forecast provides granular insights into these anticipated shifts.

Below is the detailed monthly price prediction for Ethena (ENA) for the next 12 months:

| Month/Year | Predicted Price (USD) |

|---|---|

| July 2025 | 0.353 |

| August 2025 | 0.364 |

| September 2025 | 0.369 |

| October 2025 | 0.380 |

| November 2025 | 0.399 |

| December 2025 | 0.401 |

| January 2026 | 0.383 |

| February 2026 | 0.397 |

| March 2026 | 0.399 |

| April 2026 | 0.409 |

| May 2026 | 0.392 |

| June 2026 | 0.399 |

Ethena (ENA) Yearly Price Forecast (2026 – 2035)

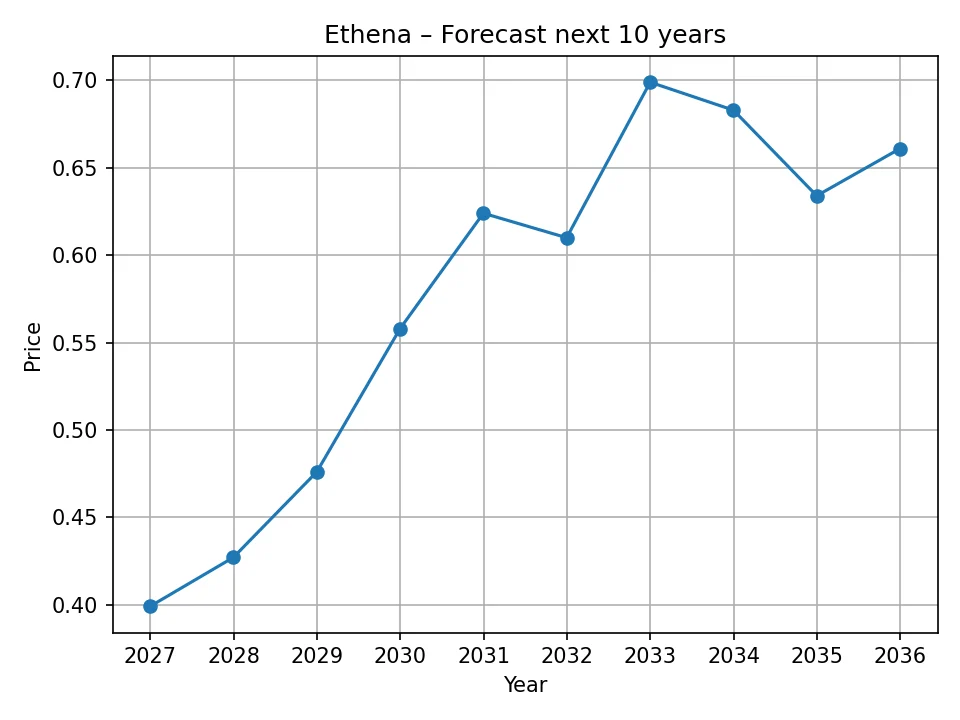

Looking further ahead, the yearly price forecast for Ethena (ENA) over the next decade, from 2026 to 2035, presents a more optimistic long-term trajectory. While the short-term forecast suggests consolidation, the extended outlook indicates a potential for gradual but significant appreciation. The EdgePredict algorithm projects ENA to slowly climb from its approximate 0.399 USD in 2026 to potentially reach highs around 0.699 USD by 2032, and then stabilize in the high 0.60 USD range by 2035. This sustained upward trend over a decade suggests that the model anticipates continued growth in the Ethena ecosystem, increased adoption of USDe, and a strengthened position within the DeFi market. The long-term forecast also accounts for potential market cycles, indicating a resilient growth path for ENA despite inherent crypto volatility. This suggests that the fundamental value proposition of Ethena is expected to solidify over time, attracting more users and capital into its ecosystem. However, it is essential to note that longer-term predictions carry a higher degree of uncertainty due to the multitude of unforeseen technological, regulatory, and market shifts that can occur over such an extended period.

The table below outlines the long-term annual price predictions for Ethena (ENA):

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.399 |

| 2027 | 0.427 |

| 2028 | 0.476 |

| 2029 | 0.558 |

| 2030 | 0.624 |

| 2031 | 0.610 |

| 2032 | 0.699 |

| 2033 | 0.683 |

| 2034 | 0.634 |

| 2035 | 0.661 |

Potential Growth Catalysts for Ethena

Several factors could serve as significant growth catalysts for Ethena and its ENA token in the coming years. One of the most impactful would be a sustained period of positive funding rates in the perpetual futures markets. If traders consistently pay a premium to hold long positions, Ethena’s yield generation mechanism for sUSDe would become highly attractive, drawing in more capital and further increasing demand for USDe. This influx of capital would solidify Ethena’s position as a preferred synthetic dollar solution. Another major catalyst would be successful integration into more mainstream DeFi protocols and traditional financial applications. Expanding beyond the current scope and becoming a widely accepted medium of exchange or collateral asset in other ecosystems would massively increase USDe’s utility and, by extension, ENA’s value.

Furthermore, continuous innovation within the Ethena protocol, such as the introduction of new collateral types for USDe, enhanced risk management tools, or cross-chain expansion, could unlock new avenues for growth and adoption. Positive regulatory clarity regarding synthetic assets and DeFi would also significantly reduce uncertainty, paving the way for greater institutional participation. Finally, a general bull market in the broader cryptocurrency space, particularly for Ethereum, would likely create a favorable environment for ENA to thrive, as investor confidence and liquidity return to the market.

Risks and Challenges for Ethena

Despite its innovative approach and potential, Ethena faces several inherent risks and challenges that could impact its future price trajectory. The primary risk revolves around the sustainability of its delta-neutral hedging strategy. While designed for stability, significant and prolonged negative funding rates in the derivatives market could lead to a decrease or even a negative yield for sUSDe holders. This would undermine one of Ethena’s core value propositions and could lead to capital outflows. Additionally, smart contract risk is always present in complex DeFi protocols. Despite rigorous audits, unforeseen vulnerabilities could lead to exploits, resulting in financial losses and a severe blow to the protocol’s reputation and ENA’s value.

Regulatory uncertainty also looms large; governments worldwide are grappling with how to classify and regulate stablecoins and synthetic assets. Overly restrictive regulations could limit Ethena’s operations, scalability, or even legality in certain jurisdictions. Furthermore, the reliance on centralized exchanges for hedging introduces counterparty risk; a failure or shutdown of a major exchange could severely impact Ethena’s ability to maintain its peg. Competitive pressures from other stablecoin projects, including those backed by fiat or other crypto assets, also pose a challenge. Ethena must continuously innovate and prove its resilience to maintain its competitive edge. Finally, market volatility in the broader crypto space, while offering opportunities, also presents risks. Extreme market downturns could test the robustness of Ethena’s hedging mechanisms to their limits, potentially leading to de-pegging events that erode user trust.

Ethena’s Position in the DeFi Landscape

Ethena’s unique approach to synthetic dollars has carved out a distinct niche within the DeFi landscape. While traditional stablecoins like USDT and USDC dominate in terms of market capitalization, they come with centralized custody and regulatory risks associated with fiat reserves. Decentralized stablecoins like DAI, on the other hand, rely on over-collateralization with various crypto assets. Ethena positions USDe as a ‘crypto-native’ stablecoin, offering a scalable and censorship-resistant alternative by leveraging liquid staking derivatives and delta-neutral hedging. This approach aims to combine the stability of stablecoins with the decentralization and yield potential of DeFi. Its success hinges on widespread adoption within the DeFi ecosystem, where USDe could become a fundamental building block for lending, borrowing, and trading activities. The ability to generate yield through sUSDe provides a powerful incentive for users to hold and integrate Ethena’s synthetic dollar into their strategies. As the demand for robust, decentralized stable assets grows, Ethena’s model offers a compelling proposition that could see it become a more prominent player, especially as the industry seeks alternatives to traditional, centralized stablecoin models.

Conclusion

In conclusion, Ethena (ENA) represents an ambitious and innovative project within the decentralized finance space, aiming to redefine the concept of a stable asset with its synthetic dollar, USDe. The protocol’s unique delta-neutral hedging strategy and its ability to generate yield through sUSDe position it as a significant contender in the evolving stablecoin landscape. While its historical price performance reflects the inherent volatility of the cryptocurrency market, the long-term algorithmic predictions suggest a potential for gradual growth and increased market penetration. The short-term outlook indicates a period of stabilization, hinting at a mature phase for the asset as it finds its footing. However, investors must remain cognizant of the considerable risks involved, including the sustainability of yield, regulatory changes, smart contract vulnerabilities, and broader market fluctuations. The future trajectory of ENA will largely depend on the continued success of the Ethena protocol, its ability to mitigate risks, foster widespread adoption of USDe, and adapt to the ever-changing dynamics of the crypto ecosystem. As with any investment in the digital asset space, thorough research and a clear understanding of personal risk tolerance are paramount.

It is important to remember that all cryptocurrency price predictions are speculative and inherently uncertain. The forecasts presented in this article, including the monthly and yearly price projections, are based on a proprietary algorithmic model named EdgePredict. We are not responsible for these predictions, and they should not be considered financial advice. The cryptocurrency market is highly volatile, and actual prices may vary significantly from these forecasts due to numerous unforeseen factors, including market sentiment shifts, regulatory developments, technological advancements, and macroeconomic events. Investors should conduct their own comprehensive research and consult with a qualified financial advisor before making any investment decisions. Never invest more than you can afford to lose.

Senior Crypto Correspondent with over 8 years of experience covering Bitcoin, altcoins, and blockchain technology for leading financial publications. Alexander holds a master’s degree in Financial Economics and specializes in in-depth market analysis, regulatory updates, and interviews with top industry figures.