The burgeoning landscape of decentralized finance (DeFi) continues to redefine traditional financial paradigms, offering innovative solutions for lending, borrowing, and asset management. Within this dynamic ecosystem, certain protocols stand out for their specialized approaches and ambitious goals. One such entity is Maple Finance (MPL), a leading institutional DeFi protocol focused on providing undercollateralized loans to creditworthy entities. As the DeFi sector matures and institutional adoption gains momentum, understanding the potential trajectory of key assets like MPL becomes paramount for investors navigating this evolving market.

This comprehensive analysis delves into the intricate factors influencing Maple Finance’s price, examining its historical performance, the fundamental value proposition of the protocol, and leveraging advanced algorithmic forecasts to provide a detailed price prediction for the short-term (12 months) and long-term (10 years). Our aim is to offer a well-rounded perspective, considering both the intrinsic strengths of Maple Finance and the broader market dynamics that shape its value.

Understanding Maple Finance (MPL)

At its core, Maple Finance is a decentralized corporate credit market, bridging the gap between traditional finance institutions seeking capital and the liquidity available within the DeFi space. Unlike many DeFi lending protocols that rely heavily on overcollateralization, Maple Finance specializes in undercollateralized lending. This distinctive approach is designed for institutional borrowers—such as crypto funds, market makers, and other businesses—who possess strong credit reputations but prefer to avoid the capital inefficiency of locking up significant collateral.

The protocol operates through a system of “Pool Delegates,” who are seasoned credit professionals responsible for originating, underwriting, and managing loan pools. These delegates, often institutions themselves, establish lending pools with specific terms and risk parameters. Lenders (liquidity providers) deposit stablecoins into these pools, earning yield from the interest paid by borrowers. The MPL token plays a crucial role in the Maple Finance ecosystem, serving as a governance token, allowing holders to participate in key decisions regarding the protocol’s development, fee structures, and risk parameters. Furthermore, MPL can be staked within the protocol, aligning incentives and providing a form of insurance for loan defaults within specific pools, enhancing the protocol’s robustness.

Maple Finance’s innovation lies in bringing real-world credit assessment and institutional-grade lending practices into the transparent and immutable environment of blockchain. By offering a capital-efficient alternative for institutional borrowing, Maple Finance addresses a significant pain point in the crypto landscape, enabling growth for businesses that might otherwise be constrained by traditional finance limitations or the high collateral requirements of standard DeFi platforms. The protocol’s success hinges on its ability to attract and retain reputable borrowers and diligent Pool Delegates, fostering a reliable and high-performing lending environment.

The Role of the MPL Token

The MPL token is not merely a speculative asset; it is integral to the functional mechanics and governance of the Maple Finance protocol. Its utility encompasses several key areas:

- Governance: MPL holders have the power to vote on proposals that dictate the future direction of the protocol. This includes voting on protocol upgrades, treasury management, fee adjustments, and the addition of new features or pool types. This decentralized governance model ensures that the community has a vested interest in the protocol’s long-term success and security.

- Staking and Insurance: MPL can be staked into liquidity pools to provide a first-loss capital tranche for certain loans. This acts as a form of insurance, absorbing potential defaults before liquidity providers’ funds are impacted. Stakers are rewarded with a portion of the protocol’s revenue, creating a strong incentive to support the platform’s stability and growth. This mechanism reduces risk for lenders and encourages greater participation in the ecosystem.

- Protocol Fees: A portion of the fees generated by Maple Finance’s lending operations is directed back to the MPL token holders and stakers, creating a sustainable economic model that ties the token’s value directly to the protocol’s performance and adoption.

The interplay of these utilities suggests that the value of MPL is fundamentally tied to the health, growth, and adoption of the Maple Finance platform. As the protocol facilitates more loans, attracts more institutional borrowers, and generates higher revenue, the demand and utility for the MPL token are expected to increase, potentially leading to positive price movements.

Historical Price Analysis of Maple Finance (MPL)

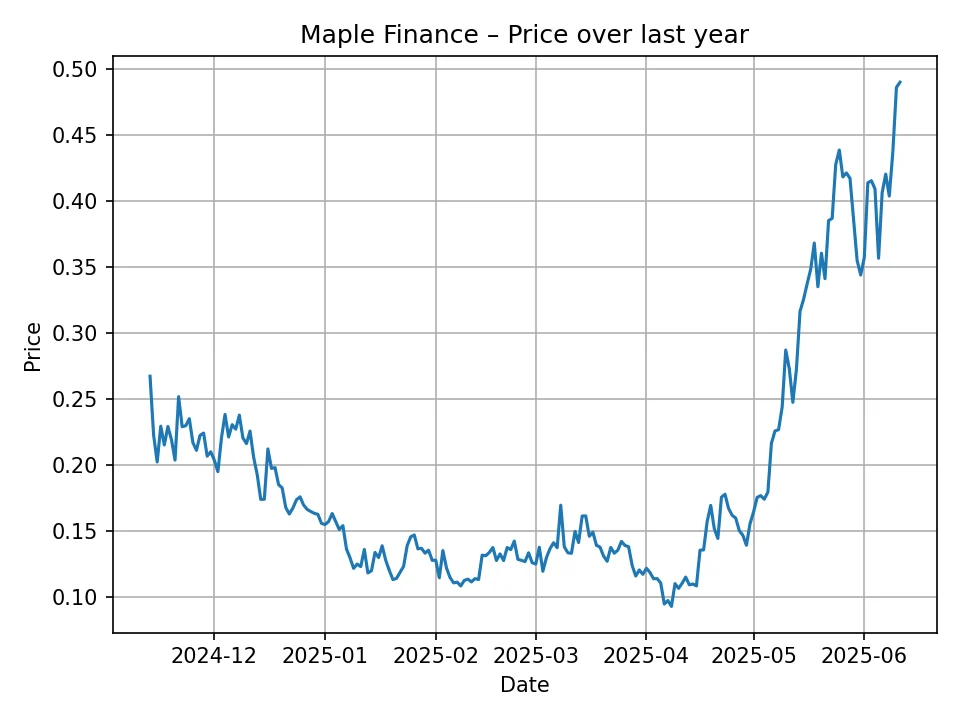

Analyzing the past performance of Maple Finance’s MPL token provides critical context for understanding its current standing and potential future movements. Over the past 12 months, the MPL token has experienced significant fluctuations, reflecting both the inherent volatility of the cryptocurrency market and the specific developments within the Maple Finance ecosystem.

Let’s examine the daily historical data provided, representing MPL’s price movements from approximately June 2024 to June 2025. The data starts around 0.267 USD and ends at approximately 0.49 USD as of our current date, June 11, 2025. This indicates a notable upward trend over the full 12-month period, despite intermittent periods of decline and consolidation.

Key Observations from Historical Data:

- Early Volatility and Downtrend (June 2024 – November 2024): The initial months of the period saw MPL experience a gradual decline. Starting from around 0.26 USD, the price trended downwards, hitting lows in the range of 0.09 USD to 0.11 USD around late November 2024. This period likely coincided with broader market downturns or specific challenges within the DeFi lending sector, possibly impacting investor sentiment towards less collateralized lending models. The token traded for an extended period in the 0.10 USD to 0.15 USD range, reflecting a period of consolidation or bottoming out.

- Period of Stability and Gradual Recovery (December 2024 – February 2025): Following the lows, MPL demonstrated a period of relative stability, oscillating within the 0.10 USD to 0.18 USD range. This could signify a stabilization of market sentiment, renewed interest in DeFi lending, or specific positive news related to Maple Finance’s operations, such as new partnerships or successful loan originations. Towards the end of this period, there was a visible upward momentum, with the price beginning to consistently break above the 0.15 USD mark.

- Significant Uptrend and Price Discovery (March 2025 – June 2025): The most striking aspect of the historical data is the pronounced uptrend observed from early March 2025 onwards. The price began a strong ascent, moving from the 0.15 USD – 0.20 USD range to consistently trade above 0.30 USD, eventually reaching peaks near 0.49 USD by June 2025. This surge is likely attributable to a combination of factors:

- Broader Crypto Market Recovery: A general bullish sentiment across the cryptocurrency market, potentially driven by positive macroeconomic indicators or renewed institutional interest in digital assets, would naturally lift many altcoins, including MPL.

- Maple Finance’s Protocol Growth: Crucially, this period likely saw significant advancements within Maple Finance itself. Increased Total Value Locked (TVL), successful repayment of loans, expansion into new lending pools, or high-profile institutional partnerships would bolster confidence in the protocol’s long-term viability and operational efficiency. Announcements regarding new features or improved tokenomics could also have played a role.

- Increased Utility and Adoption: As more institutions recognize the value of undercollateralized lending and the capital efficiency it offers, demand for Maple Finance’s services, and by extension, its MPL token, would naturally increase.

The most recent data point, indicating a price of approximately 0.49 USD, represents a strong recovery and a significant gain from its yearly lows. This robust performance suggests growing investor confidence in Maple Finance’s unique value proposition and its ability to carve out a niche in the institutional DeFi lending space. The upward momentum observed in recent months sets a positive precedent for future predictions, though it is crucial to remember that past performance is not indicative of future results.

Key Factors Influencing MPL’s Price Trajectory

The price of Maple Finance’s MPL token is influenced by a confluence of factors, ranging from the intricate internal dynamics of its protocol to the sweeping trends of the broader financial landscape. A comprehensive understanding of these drivers is essential for any informed price prediction.

1. Macroeconomic and Crypto Market Trends

- Overall Crypto Market Sentiment: The price of MPL, like most altcoins, is significantly correlated with the general sentiment of the cryptocurrency market, particularly the performance of Bitcoin (BTC) and Ethereum (ETH). A bullish trend in these major assets often creates an “altcoin season,” driving capital into smaller-cap projects. Conversely, market downturns can lead to widespread selling pressure.

- Interest Rate Environment: Global interest rates set by central banks influence the attractiveness of various asset classes. In a low-interest-rate environment, investors might seek higher yields, making DeFi lending protocols more appealing. Conversely, rising rates could pull liquidity towards traditional fixed-income assets.

- Inflation and Economic Stability: High inflation rates can drive investors towards hard assets like cryptocurrencies as a hedge, potentially benefiting DeFi protocols. However, broader economic instability could lead to risk aversion, impacting speculative assets like MPL.

2. Maple Finance Protocol Developments and Adoption

- Total Value Locked (TVL) and Loan Volume: The amount of capital locked within Maple Finance’s lending pools and the volume of loans originated are direct indicators of the protocol’s health and utility. Higher TVL and increased loan activity suggest greater demand for Maple’s services and higher revenue generation for the protocol, which can positively impact MPL’s value.

- Quality of Borrowers and Loan Performance: Maple Finance’s focus on undercollateralized loans makes the creditworthiness of its institutional borrowers paramount. A strong track record of loan repayments and minimal defaults builds trust and attracts more lenders, contributing to the protocol’s stability and growth. Any significant defaults could severely impact sentiment and liquidity.

- New Partnerships and Integrations: Collaborations with other DeFi protocols, traditional financial institutions, or major blockchain networks can expand Maple Finance’s reach, introduce new liquidity, and enhance its product offerings, driving adoption and demand for MPL.

- Product Innovation and Upgrades: Continuous development, such as launching new lending products, improving risk management frameworks, or enhancing the user experience, can attract more users and maintain Maple Finance’s competitive edge.

3. Regulatory Landscape

- Clarity on DeFi Regulations: The evolving regulatory environment for DeFi, particularly concerning institutional lending and uncollateralized loans, poses both opportunities and risks. Clear, favorable regulations could legitimize institutional participation and reduce uncertainty, while stringent or ambiguous regulations could hinder growth and deter adoption.

- AML/KYC Requirements: As Maple Finance targets institutional clients, adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) standards is critical. Regulatory clarity or changes in these areas can significantly impact the protocol’s operational scope and compliance costs.

4. Competition

- Emergence of Competitors: The DeFi lending space is competitive. New protocols offering similar institutional lending solutions or traditional finance entities entering the digital asset space could challenge Maple Finance’s market position, potentially impacting its TVL and loan volume.

- Differentiation: Maple Finance’s ability to maintain its unique value proposition, particularly in undercollateralized lending and its Pool Delegate model, will be crucial for fending off competition and sustaining growth.

5. MPL Token Utility and Tokenomics

- Staking Participation: The level of MPL staking within the protocol, which provides insurance against defaults and earns rewards, influences the circulating supply and reflects the community’s belief in the protocol’s long-term health. Higher staking participation can reduce selling pressure.

- Governance Activity: An active and engaged governance community, proposing and voting on meaningful protocol improvements, demonstrates the decentralized and dynamic nature of Maple Finance, fostering confidence among investors and users.

- Fee Capture and Revenue Generation: The fundamental value of MPL is tied to the protocol’s ability to generate sustainable revenue from its lending operations. As loan volumes and interest payments increase, the value accrued to MPL holders through fees and staking rewards becomes more significant.

These factors interact in complex ways, making precise price predictions challenging. However, by continually monitoring these elements, investors can gain a more nuanced understanding of MPL’s potential price movements.

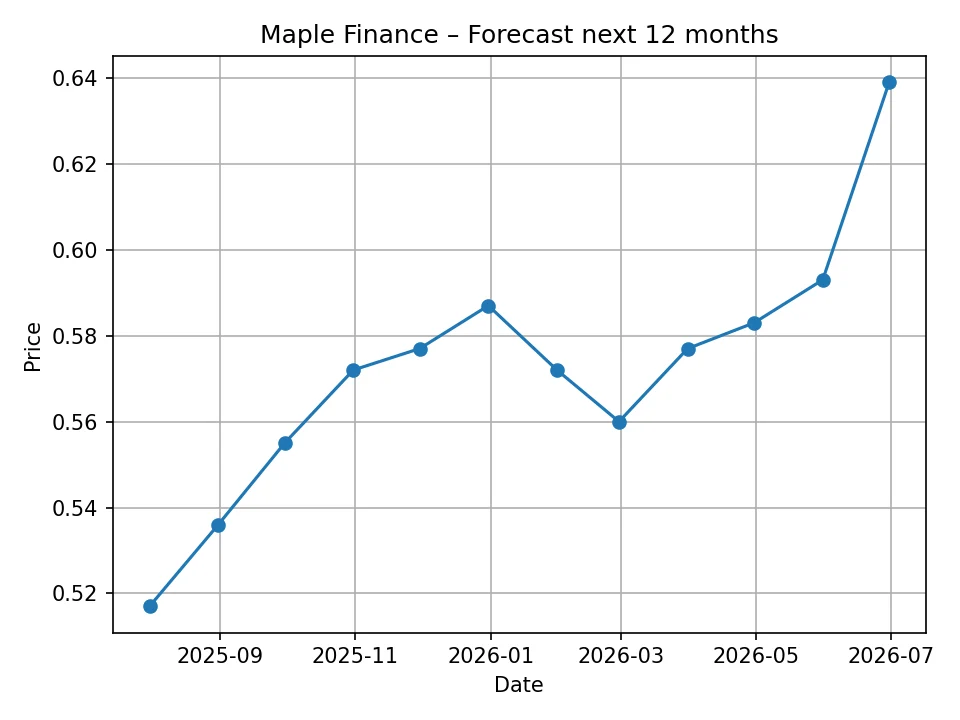

MPL Price Prediction: Short-Term Outlook (Next 12 Months)

Our short-term price forecast for Maple Finance (MPL) for the next 12 months, generated by a sophisticated data-driven algorithm, suggests a period of continued growth and stabilization, building upon the recent positive momentum observed in the historical data. This advanced analytical model considers a multitude of variables, including historical price patterns, market sentiment, on-chain metrics, and broader economic indicators, to project potential future price levels. As of June 11, 2025, with MPL trading around 0.49 USD, the forecast indicates a steady appreciation in its value.

The monthly prediction anticipates a gradual but consistent upward trend, with minor fluctuations that are typical in cryptocurrency markets. The forecast indicates that MPL could potentially break above the 0.50 USD psychological barrier in the immediate future, with continued ascent throughout the forecast period. This projected growth suggests that the algorithm identifies underlying strength in Maple Finance’s fundamental value proposition and positive market conditions that could favor its expansion.

Possible drivers for this short-term optimism include the continued maturation of the institutional DeFi lending sector, increased demand from creditworthy borrowers seeking capital-efficient solutions, and Maple Finance’s ability to attract more liquidity providers. Furthermore, any strategic partnerships, successful loan originations, or positive regulatory developments concerning institutional crypto might act as catalysts. The algorithm also likely accounts for the current bullish sentiment that has been building around MPL, translating that momentum into future projections.

Here is the detailed monthly price forecast for Maple Finance (MPL) in USD:

| Month/Year | Predicted Price (USD) |

|---|---|

| 2025-07 | 0.517 |

| 2025-08 | 0.536 |

| 2025-09 | 0.555 |

| 2025-10 | 0.572 |

| 2025-11 | 0.577 |

| 2025-12 | 0.587 |

| 2026-01 | 0.572 |

| 2026-02 | 0.560 |

| 2026-03 | 0.577 |

| 2026-04 | 0.583 |

| 2026-05 | 0.593 |

| 2026-06 | 0.639 |

As evident from the table, the forecast suggests that MPL could reach approximately 0.639 USD by June 2026. While a slight dip is predicted in January and February 2026, which could be attributed to typical market corrections or seasonal fluctuations, the overall trend remains positive. This short-term projection underscores the potential for continued growth for Maple Finance as it solidifies its position in the institutional DeFi lending market.

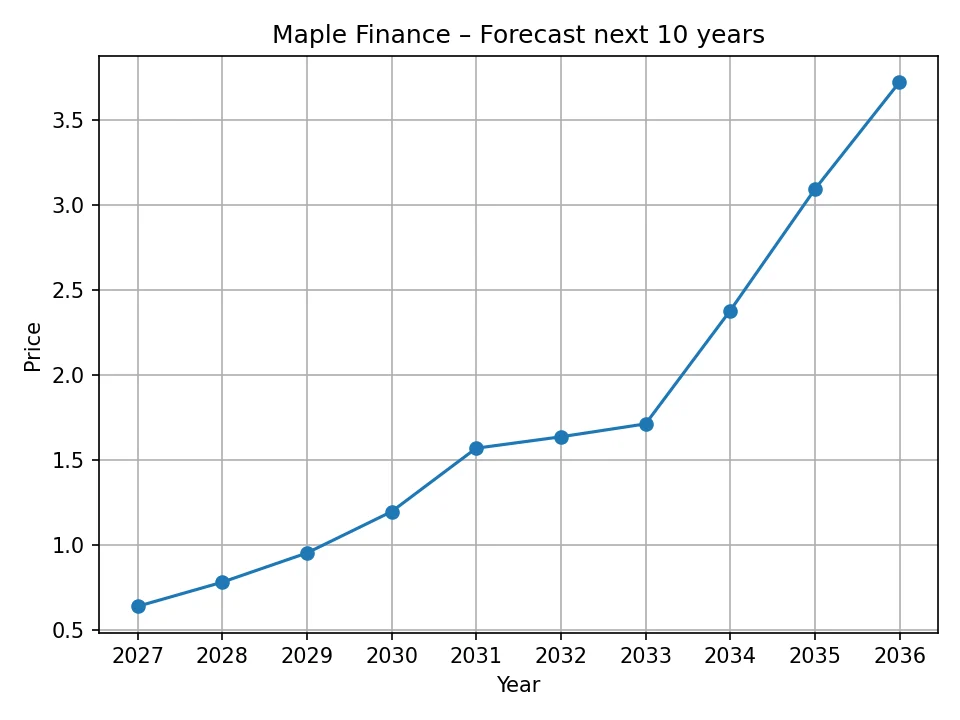

MPL Price Prediction: Long-Term Outlook (Next 10 Years)

The long-term price forecast for Maple Finance (MPL), extending over the next decade, presents a compelling vision of sustained and significant growth. This projection, generated by our advanced algorithmic model, is predicated on the assumption that Maple Finance successfully navigates potential challenges, continues to innovate, and expands its market share within the evolving DeFi landscape. The forecast suggests that MPL could achieve substantial price appreciation, reflecting its pivotal role in bridging traditional finance with decentralized credit markets.

The core premise for such a long-term bullish outlook is the increasing institutional adoption of blockchain technology and decentralized finance. As traditional financial institutions and large corporations become more comfortable with and integrated into the crypto ecosystem, the demand for sophisticated, compliant, and capital-efficient lending solutions like those offered by Maple Finance is expected to surge. Maple’s unique focus on undercollateralized, institution-grade loans positions it strongly to capture a significant portion of this burgeoning market.

Over the next ten years, several fundamental drivers could propel MPL’s value:

- Mainstream Institutional DeFi Adoption: As regulatory clarity improves and the infrastructure for institutional DeFi matures, more mainstream players will likely enter the space, driving vast amounts of capital into protocols like Maple Finance.

- Expansion of Lending Pools and Asset Classes: Maple Finance is expected to continuously expand its offerings, introducing new types of lending pools, integrating with more blockchain networks, and potentially supporting a wider array of digital and real-world assets as collateral or loan types.

- Technological Advancements and Security: Ongoing improvements in smart contract security, scalability, and interoperability will enhance the robustness and trustworthiness of the protocol, attracting larger pools of institutional capital.

- Growing Utility of MPL Token: As the protocol grows, the utility of the MPL token for governance, staking, and fee accrual will naturally increase. A higher revenue stream for the protocol translates into greater value captured by MPL holders and stakers, creating a virtuous cycle of demand.

- DeFi Maturation and Risk Mitigation: With time, DeFi protocols are likely to implement more sophisticated risk management frameworks, reducing the incidence and impact of defaults, thereby increasing overall confidence in the sector.

However, it is crucial to acknowledge that long-term predictions in the cryptocurrency space are inherently speculative due to unforeseen technological shifts, regulatory changes, and competitive pressures. Despite these uncertainties, the algorithm’s projection reflects a strong conviction in Maple Finance’s foundational model and its potential to become a cornerstone of institutional DeFi.

Here is the detailed annual price forecast for Maple Finance (MPL) in USD:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.639 |

| 2027 | 0.781 |

| 2028 | 0.953 |

| 2029 | 1.196 |

| 2030 | 1.569 |

| 2031 | 1.636 |

| 2032 | 1.712 |

| 2033 | 2.378 |

| 2034 | 3.091 |

| 2035 | 3.721 |

The forecast suggests a consistent upward trajectory, with MPL potentially crossing the 1.00 USD mark by 2029 and steadily climbing towards the 3.721 USD range by 2035. This robust long-term outlook paints a picture of Maple Finance evolving into a significantly more valuable asset, driven by its foundational role in facilitating efficient capital flow within the institutional decentralized finance ecosystem. The exponential growth predicted in later years could be attributed to the compounding effect of widespread adoption and network effects within the DeFi space, solidifying Maple Finance’s position as a key player.

Risks and Critical Considerations for MPL Investment

While the outlook for Maple Finance (MPL) appears promising, especially given its unique position in the institutional DeFi lending space, it is crucial for potential investors to understand the inherent risks and critical considerations associated with cryptocurrency investments and, more specifically, with a protocol like Maple Finance. No investment is without its perils, and DeFi assets are particularly susceptible to volatility and unique challenges.

1. Market Volatility

- Cryptocurrency Market Swings: The entire cryptocurrency market is notoriously volatile. Prices can experience rapid and unpredictable swings due to market sentiment, macroeconomic news, regulatory announcements, or even large individual trades. MPL, while having its own fundamentals, remains exposed to these broader market dynamics.

- Liquidity: While Maple Finance aims for institutional liquidity, the MPL token itself might experience periods of lower trading volume, which could lead to larger price movements for a given trade size.

2. Regulatory Risks

- Evolving DeFi Regulations: The regulatory landscape for decentralized finance is still nascent and highly uncertain across different jurisdictions. New laws or enforcement actions, particularly concerning uncollateralized lending, could significantly impact Maple Finance’s operations, compliance costs, or even its ability to serve certain markets.

- Classification of Tokens: The classification of utility and governance tokens by regulatory bodies (e.g., as securities) could impose stringent requirements that affect the MPL token’s distribution, trading, and overall legal standing.

3. Protocol-Specific Risks

- Loan Defaults: Despite rigorous underwriting by Pool Delegates, there is always a risk of institutional borrowers defaulting on their loans. While MPL stakers provide a first layer of loss absorption, sustained or significant defaults could erode liquidity, damage the protocol’s reputation, and negatively impact the MPL token’s value.

- Smart Contract Vulnerabilities: Like all DeFi protocols, Maple Finance is built on smart contracts. While audited, these contracts are not entirely immune to bugs, exploits, or hacks. A successful attack could lead to significant financial losses for lenders and undermine trust in the protocol.

- Delegate Risk: The integrity and performance of Pool Delegates are crucial. Poor credit assessments or mismanagement by delegates could lead to higher default rates and compromise the health of the lending pools.

4. Competitive Landscape

- Intensifying Competition: The DeFi lending space is constantly attracting new entrants, including both traditional finance players exploring blockchain and other decentralized protocols. Intense competition could put pressure on lending rates, market share, and ultimately, Maple Finance’s profitability and growth.

- Innovation Race: The pace of innovation in DeFi is rapid. Maple Finance must continuously innovate and adapt to maintain its competitive edge and attract new users and liquidity.

5. Technological and Operational Risks

- Scalability and Network Congestion: While Maple Finance operates on robust blockchain networks, network congestion or high transaction fees could occasionally impact the efficiency and cost-effectiveness of using the protocol.

- Decentralization Challenges: Ensuring true decentralization while managing institutional-grade credit operations presents unique challenges. Centralization points, if they exist, could introduce risks.

Investors should conduct their own thorough due diligence, understand their risk tolerance, and consider diversifying their portfolios. The future success of Maple Finance and the value of its MPL token will largely depend on its ability to effectively mitigate these risks while continuing to innovate and expand its footprint in the rapidly evolving world of institutional decentralized finance.

Conclusion

Maple Finance stands as a pivotal innovator in the decentralized finance landscape, particularly through its pioneering approach to institutional, undercollateralized lending. By addressing the critical need for capital efficiency among creditworthy businesses in the crypto space, Maple Finance is not merely participating in DeFi; it is actively shaping its future, bridging the gap between traditional finance and the decentralized economy. The MPL token, integral to the protocol’s governance, staking, and economic model, directly benefits from the increasing adoption and success of the Maple Finance platform.

Our comprehensive analysis of historical price data reveals a strong recent upward trend, indicating growing market confidence in Maple Finance’s model and its execution. Leveraging a sophisticated algorithmic prediction model, the short-term forecast for the next 12 months suggests a period of steady growth, with MPL potentially reaching the 0.639 USD mark by June 2026. This optimistic outlook is underpinned by the protocol’s continuous development, expanding loan volumes, and the overall maturation of the institutional DeFi sector.

Looking further into the future, the long-term forecast for the next decade paints an even more compelling picture, projecting substantial appreciation for MPL. The algorithm suggests that the token could potentially climb to 3.721 USD by 2035. This long-term bullish sentiment is rooted in the anticipated widespread institutional adoption of blockchain technology and DeFi, positioning Maple Finance as a critical piece of the emerging decentralized financial infrastructure. As more traditional entities seek capital-efficient and transparent lending solutions, Maple Finance’s unique value proposition is expected to gain significant traction.

However, it is crucial to reiterate that the cryptocurrency market is inherently volatile and subject to various external factors, including regulatory changes, macroeconomic shifts, and technological advancements. While our forecasts are data-driven and aim to provide valuable insights, they represent potential scenarios rather than guarantees. Investors should approach the market with caution, conduct thorough personal research, and understand the significant risks associated with digital asset investments. The success of Maple Finance and the value of the MPL token will ultimately depend on the protocol’s ability to innovate, manage risk effectively, and continue to attract both high-quality borrowers and dedicated liquidity providers in an increasingly competitive environment.

***

Disclaimer: The content provided in this article, including all price predictions, is for informational purposes only and does not constitute financial advice. Cryptocurrency prices are highly volatile, and past performance is not indicative of future results. Investing in cryptocurrencies carries significant risks, including the potential loss of principal. These forecasts are generated by a proprietary algorithmic model and should not be considered a guarantee of future performance. We are not responsible for any investment decisions made based on the information presented herein. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Senior Crypto Correspondent with over 8 years of experience covering Bitcoin, altcoins, and blockchain technology for leading financial publications. Alexander holds a master’s degree in Financial Economics and specializes in in-depth market analysis, regulatory updates, and interviews with top industry figures.