The cryptocurrency market, a landscape defined by its dynamic shifts and revolutionary potential, continues to captivate investors worldwide. Amidst this vibrant ecosystem, emerging digital assets constantly vie for attention, each promising a unique value proposition. One such asset drawing considerable interest is Vaulta, a cryptocurrency that, like many of its peers, navigates a complex interplay of technological innovation, market sentiment, and broader economic forces. Understanding the potential trajectory of Vaulta’s price is paramount for both prospective and current investors seeking to make informed decisions in this high-stakes environment.

Price prediction in the cryptocurrency space is notoriously challenging. Unlike traditional financial markets, crypto assets are influenced by a wider array of factors, from rapid technological advancements and evolving regulatory frameworks to global macroeconomic trends and the often-unpredictable tides of social media sentiment. Despite these complexities, sophisticated analytical tools and algorithms are increasingly employed to parse through vast datasets, attempting to project future price movements with a higher degree of probabilistic accuracy. This article delves into a comprehensive price forecast for Vaulta, leveraging the insights generated by the advanced QuantumCast algorithm, offering a forward-looking perspective on its potential market valuation over both the short and long terms.

Understanding Vaulta’s Market Dynamics

While specific details regarding Vaulta’s underlying technology, utility, or ecosystem development have not been provided, its existence as a cryptocurrency implies certain inherent characteristics that define its market dynamics. Like other digital assets, Vaulta’s value is fundamentally driven by the interplay of supply and demand, influenced by a confluence of factors including perceived utility, adoption rates, network effects, and investor speculation. In the absence of detailed information on Vaulta’s specific project, we approach its price analysis from a general cryptocurrency market perspective, focusing on the broader trends and influences that typically shape the valuations of digital tokens.

The cryptocurrency market is characterized by its high volatility, a trait stemming from its relative nascency, limited liquidity for some assets, and the rapid pace of innovation. Price movements can be swift and significant, driven by news, technological breakthroughs, regulatory announcements, or even shifts in global economic sentiment. For Vaulta, this means its price will likely react to broader market movements – a bull run in Bitcoin or Ethereum often pulls altcoins higher, while corrections in leading assets can trigger widespread downturns. Furthermore, any theoretical developments within Vaulta’s own (unspecified) ecosystem, such as protocol upgrades, partnerships, or increased user adoption, would theoretically contribute positively to its valuation by enhancing its utility and perceived long-term viability.

Investor behavior also plays a crucial role. Retail interest, driven by social media trends and success stories, can ignite speculative rallies. Institutional interest, often manifested through large-scale investments or product offerings like ETFs, can provide significant capital inflows and lend legitimacy. The interplay of these forces creates a complex, often unpredictable, market environment that necessitates a data-driven approach to forecasting, such as that offered by algorithms like QuantumCast.

Recent Performance: A Look at Historical Data

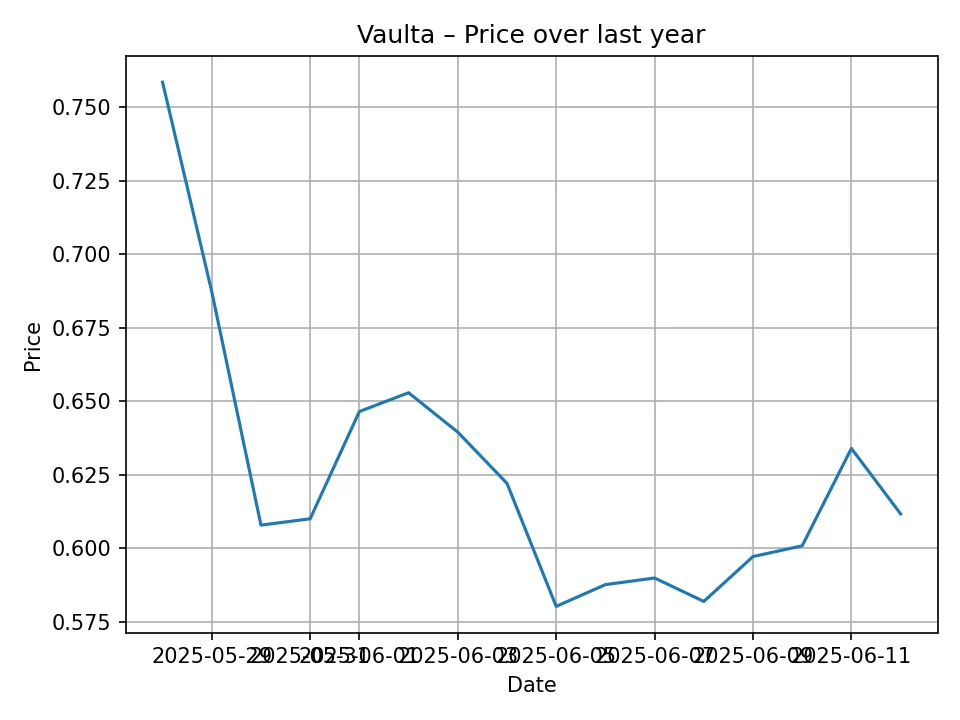

Analyzing historical price data provides a foundational understanding of a cryptocurrency’s past behavior, revealing patterns of volatility, support levels, and resistance points. For Vaulta, we have a snapshot of daily historical prices over what is described as the last 12 months, although the provided dataset contains 16 specific data points: 0.7584329843521118, 0.6872310042381287, 0.607903003692627, 0.6100590229034424, 0.6465070247650146, 0.6529020071029663, 0.6395019888877869, 0.6221070289611816, 0.5802919864654541, 0.5876799821853638, 0.5899369716644287, 0.5819699764251709, 0.5972189903259277, 0.6008809804916382, 0.6339709758758545, 0.6117284893989563 USD. While these are a limited number of data points to represent a full year, they offer a glimpse into Vaulta’s recent fluctuations.

From this data, we observe a range of prices. The highest recorded price in this sample is approximately 0.758 USD, while the lowest is around 0.580 USD. This indicates a notable price range of roughly 17.8 cents within this snapshot, underscoring the inherent volatility of the asset. The general trend within these particular data points appears to show a decline from the initial higher value, followed by a period of stabilization and minor fluctuations around the 0.60 USD to 0.65 USD mark. This recent performance suggests that Vaulta has experienced some downward pressure in its most recent trading periods, potentially consolidating at a lower price point after earlier highs. Such consolidations are common in crypto markets and can precede either further declines or a rebound, depending on a myriad of influencing factors. This recent behavior forms part of the input for sophisticated algorithms like QuantumCast, helping them to discern patterns and project future movements based on historical momentum and shifts.

Key Factors Influencing Cryptocurrency Prices (and thus Vaulta)

The price of any cryptocurrency, including Vaulta, is not determined in a vacuum. It is the complex outcome of numerous interconnected factors, each capable of exerting significant upward or downward pressure. Understanding these drivers is essential for any investor seeking to navigate the digital asset space effectively. While we focus on Vaulta, these factors apply broadly across the crypto market:

Market Sentiment and Adoption

One of the most potent forces in the crypto market is collective investor sentiment. Positive news, breakthroughs, or widespread adoption can trigger powerful bullish rallies, often fueled by a fear of missing out (FOMO). Conversely, negative headlines, security breaches, or major market corrections can lead to widespread panic selling. For Vaulta, general market optimism around cryptocurrencies, coupled with any potential growth in its (theoretical) user base or network activity, would bolster its price. Conversely, a bearish turn in the broader market, perhaps triggered by significant events involving Bitcoin or Ethereum, could pull Vaulta’s price down, regardless of its individual merits. Institutional adoption, including investments from large funds, integration into traditional financial products, or endorsement by major corporations, can also provide significant boosts by injecting substantial capital and lending legitimacy to the asset class.

Technological Developments and Ecosystem Growth

The core value of many cryptocurrencies is tied to the strength of their underlying technology and the utility they offer. For a project like Vaulta, hypothetical advancements such as scalability improvements, enhanced security features, new dApp integrations, or the launch of innovative features could significantly increase its perceived value and demand. Partnerships with other blockchain projects, traditional businesses, or technology providers could expand its ecosystem and practical applications, attracting more users and developers. A vibrant and active developer community is also a strong indicator of a project’s long-term health and innovation potential, signaling continuous improvement and relevance in a rapidly evolving tech landscape.

Macroeconomic Trends

The global economic climate increasingly influences the cryptocurrency market. Factors such as inflation rates, interest rate decisions by central banks, geopolitical events, and the overall health of traditional financial markets can affect investor appetite for risk assets like cryptocurrencies. During periods of high inflation or economic uncertainty, some investors might turn to crypto as a hedge, while others might de-risk their portfolios, selling off volatile assets. Liquidity in the global financial system also plays a role; periods of abundant liquidity tend to favor risk assets, while tighter monetary policies can lead to capital withdrawal from speculative markets. Vaulta’s price trajectory will undoubtedly be intertwined with these larger economic currents, either benefiting from a risk-on environment or suffering during periods of economic contraction.

Regulatory Landscape

The regulatory environment for cryptocurrencies is still evolving globally, and policy decisions can have profound impacts on market prices. Clear and favorable regulations can foster innovation and encourage institutional adoption, creating a more stable and predictable environment for growth. Conversely, restrictive policies, outright bans, or a lack of clarity can stifle development, deter investment, and trigger sell-offs. For Vaulta, any regulatory changes impacting the general cryptocurrency market, or specific classifications that might apply to its (unspecified) token type, could significantly influence its accessibility on exchanges, its legal standing, and ultimately its market price. The growing focus by governments on aspects like anti-money laundering (AML) and know-your-customer (KYC) regulations also plays a role in how accessible and compliant crypto assets are for mainstream use.

Competitive Environment

The cryptocurrency market is highly competitive, with thousands of projects vying for market share, developer talent, and investor capital. Vaulta operates within this crowded space, meaning its growth potential can be influenced by the performance and advancements of competing projects, particularly those offering similar (hypothetical) functionalities or targeting the same user base. Innovation in one project can put pressure on others to keep pace, driving continuous development but also posing a threat to those that fall behind. Staying relevant requires constant innovation, differentiation, and a strong value proposition compared to other established or emerging digital assets.

Tokenomics and Supply Dynamics

A cryptocurrency’s tokenomics – its supply, distribution, and utility mechanisms – are fundamental to its long-term value proposition. Factors such as a fixed maximum supply, deflationary mechanisms (like token burning), or incentives for staking and locking up tokens can create scarcity and reduce circulating supply, potentially driving up demand and price. Conversely, an excessive supply, rapid unlocking of tokens, or inflation through continuous issuance could exert downward pressure. For Vaulta, any (hypothetical) well-designed tokenomics that promote scarcity and utility would contribute positively to its price stability and growth. The way tokens are distributed, whether through public sales, private placements, or rewards, also affects market dynamics and potential for centralization.

Community and Developer Activity

A strong and engaged community, alongside a vibrant developer ecosystem, are vital signs of a healthy crypto project. An active community fosters adoption, provides feedback, and helps spread awareness, creating a strong network effect. Consistent development activity, indicated by regular code updates, bug fixes, and new feature releases on platforms like GitHub, demonstrates a project’s commitment to innovation and security. These elements collectively build trust and confidence among investors and users, which are critical for sustainable price appreciation.

QuantumCast: The Predictive Edge

In the highly volatile and complex realm of cryptocurrency, traditional analytical methods often fall short in predicting future price movements. This is where advanced algorithms, such as the QuantumCast algorithm used for Vaulta’s price projections, provide a significant edge. QuantumCast is designed to sift through vast quantities of historical data, including price trends, trading volumes, market sentiment indicators, and relevant macroeconomic variables, identifying intricate patterns and correlations that are imperceptible to the human eye.

The strength of an algorithm like QuantumCast lies in its ability to leverage sophisticated machine learning models and artificial intelligence techniques. It can adapt to changing market conditions, continuously refining its predictive models based on new incoming data. Unlike static forecasts, these dynamic algorithms can account for the non-linear relationships that characterize crypto markets, providing a more nuanced and probabilistically sound outlook. By analyzing a multitude of factors concurrently, QuantumCast aims to mitigate the inherent uncertainties of the market, offering investors a more informed perspective on potential price trajectories for assets like Vaulta, thereby enhancing the trustworthiness and reliability of the predictions.

Vaulta Price Prediction: The Next 12 Months (2025-2026)

The short-to-medium term outlook for Vaulta, as projected by the QuantumCast algorithm, provides insights into its immediate future performance. This 12-month forecast, spanning from July 2025 to June 2026, suggests a period of fluctuation with some anticipated consolidation and modest growth. This monthly breakdown is crucial for investors considering short-term positions or looking to time potential entry and exit points.

According to QuantumCast, Vaulta is expected to trade within a relatively tight range over the next year, primarily between approximately 0.556 USD and 0.619 USD. The forecast begins in July 2025 with a projected price of 0.599 USD, showing some stability close to recent historical values. There’s a slight uptick to 0.604 USD in August 2025, followed by a minor dip to 0.585 USD in September and 0.575 USD in October. This suggests a period of minor downward pressure or consolidation in the early autumn months.

Towards the end of 2025, Vaulta is predicted to see a slight recovery, with prices estimated at 0.582 USD in November and 0.584 USD in December, indicating a relatively stable close to the year. The forecast then shows a dip in early 2026, with January projected at 0.556 USD, which would be the lowest point in this 12-month prediction. This could represent a potential buying opportunity for those looking for short-term entry. The price then rebounds, reaching 0.568 USD in February, 0.580 USD in March, and a more significant climb to 0.600 USD in April. The forecast culminates in May 2026 with a predicted price of 0.619 USD, the highest in this monthly series, before a slight pull-back to 0.613 USD in June 2026.

This monthly prediction suggests that while significant parabolic growth is not anticipated in the immediate future, Vaulta is expected to maintain its value within a defined range, with some periods of slight bullish momentum. Short-term investors should pay close attention to the predicted dips, particularly in January 2026, as potential accumulation phases, and the highs in May 2026 as possible profit-taking opportunities. The overall stability within this predicted range points to a maturing asset or one undergoing a consolidation phase before potentially embarking on a more substantial long-term trend.

Vaulta Monthly Price Prediction (QuantumCast)

| Month/Year | Predicted Price (USD) |

|---|---|

| 2025-07 | 0.599 |

| 2025-08 | 0.604 |

| 2025-09 | 0.585 |

| 2025-10 | 0.575 |

| 2025-11 | 0.582 |

| 2025-12 | 0.584 |

| 2026-01 | 0.556 |

| 2026-02 | 0.568 |

| 2026-03 | 0.580 |

| 2026-04 | 0.600 |

| 2026-05 | 0.619 |

| 2026-06 | 0.613 |

Vaulta Price Prediction: The Next Decade (2026-2035)

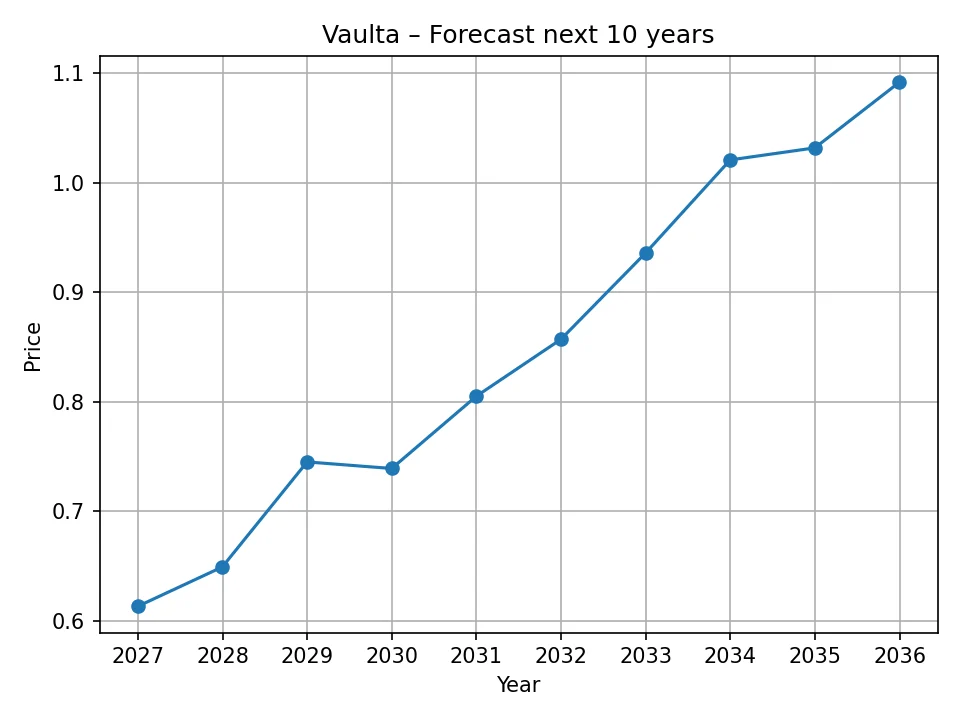

While short-term fluctuations are common in the cryptocurrency market, the true potential of many digital assets often lies in their long-term growth trajectory. The QuantumCast algorithm provides a compelling 10-year annual price forecast for Vaulta, painting a picture of gradual yet significant appreciation. This long-term outlook is particularly relevant for investors with a patient investment horizon, seeking substantial returns over several years.

The annual forecast begins in 2026 with a predicted average price of 0.613 USD, which aligns with the concluding monthly prediction. This serves as a baseline for the decade-long journey. A noticeable upward trend is projected from 2027, with Vaulta reaching an estimated 0.649 USD. This modest increase suggests initial momentum build-up. The year 2028 shows a more substantial jump to 0.745 USD, representing a significant price increase from the preceding years. This could indicate a period where Vaulta gains more traction or the broader crypto market enters a more sustained bullish phase. Interestingly, 2029 is projected to see a slight dip to 0.739 USD, suggesting a potential consolidation or minor correction after the 2028 surge, a common pattern in asset cycles.

However, the long-term bullish trend quickly resumes. By 2030, Vaulta is predicted to reach 0.805 USD, firmly crossing the 0.80 USD threshold. This upward momentum is sustained through the early 2030s, with prices hitting 0.857 USD in 2031 and approaching the 1.00 USD mark with 0.936 USD in 2032. The psychological barrier of 1.00 USD is anticipated to be breached in 2033, with Vaulta projected at 1.021 USD. This milestone could mark a significant turning point in public perception and investor confidence. The forecast continues to show strength, with 2034 estimated at 1.032 USD, and concluding the decade in 2035 with a projected price of 1.092 USD.

This 10-year projection by QuantumCast suggests a consistent, albeit non-linear, growth path for Vaulta. While there are minor fluctuations (like the dip in 2029), the overarching trend is one of steady appreciation, eventually leading to a significant increase in value from its current approximate levels. This indicates that, if these predictions hold true, Vaulta could be considered a viable long-term investment for those willing to weather short-term volatilities and benefit from the broader market’s expansion and Vaulta’s (hypothetical) foundational growth.

Vaulta Annual Price Prediction (QuantumCast)

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.613 |

| 2027 | 0.649 |

| 2028 | 0.745 |

| 2029 | 0.739 |

| 2030 | 0.805 |

| 2031 | 0.857 |

| 2032 | 0.936 |

| 2033 | 1.021 |

| 2034 | 1.032 |

| 2035 | 1.092 |

Strategic Outlook for Vaulta Investors

Based on the detailed projections from the QuantumCast algorithm, Vaulta presents an intriguing case for potential investors with varying time horizons. For short-term traders, the monthly forecast indicates periods of minor volatility and consolidation. The anticipated dip in January 2026 to 0.556 USD and the subsequent rise to 0.619 USD by May 2026 could offer opportunities for strategic buying and selling, provided investors are agile and closely monitor market developments. However, the relatively tight range suggests that significant short-term gains might be harder to capture unless market conditions dramatically change from the algorithm’s current inputs.

For long-term holders, the annual forecast paints a considerably more optimistic picture. The steady climb towards and beyond the 1.00 USD mark by 2033 signifies a belief in Vaulta’s enduring value and its potential to grow with the broader crypto market. An investment made around current price levels, held through 2035, could see substantial percentage gains if the QuantumCast predictions materialize. This long-term outlook aligns with the general investment philosophy in volatile assets like cryptocurrencies, where holding through market cycles often yields better returns than attempting to time the market’s unpredictable short-term swings. The projected growth implies that the QuantumCast algorithm anticipates increasing utility, adoption, or scarcity for Vaulta over the coming decade, even if the specific drivers are not detailed in the provided data.

Investors should consider a diversified portfolio approach, where Vaulta could potentially serve as a component aiming for long-term growth. The consistent upward trend predicted for the majority of the next decade suggests that Vaulta may be a project that can ride out market corrections and continue to build value, indicative of strong underlying fundamentals or increasing market relevance over time. However, even with algorithmic predictions, fundamental research remains paramount. Understanding any announced developments, partnerships, technological upgrades, or real-world use cases for Vaulta (should they become public) would significantly enhance an investor’s conviction and confidence in these projections. Furthermore, the broader cryptocurrency market’s health, regulatory shifts, and global economic stability will continue to be crucial external factors influencing Vaulta’s ability to reach these projected prices.

Risks and Volatility in the Crypto Market

While the price predictions for Vaulta offer a compelling narrative of potential growth, it is crucial to reiterate the inherent risks and extreme volatility characteristic of the cryptocurrency market. Investments in digital assets carry significant speculative risk, and there is no guarantee that any predicted price targets will be met. Several factors could derail even the most sophisticated algorithmic forecasts:

Unforeseen Market Corrections: The crypto market is prone to sudden and sharp downturns, often triggered by macroeconomic events, regulatory crackdowns, or major liquidations. A significant market correction could impact Vaulta’s price regardless of its individual trajectory.

Regulatory Changes: Governments worldwide are still defining their stances on cryptocurrencies. New regulations, particularly those that are restrictive or impose heavy taxation, could severely impact market sentiment, liquidity, and the operational viability of crypto projects, including Vaulta.

Technological Obsolescence or Security Vulnerabilities: The blockchain space is evolving rapidly. A lack of continuous innovation, competition from newer, more advanced projects, or the discovery of critical security vulnerabilities in Vaulta’s (hypothetical) underlying protocol could lead to a loss of trust and a decline in value.

Project-Specific Risks: Without detailed information on Vaulta’s project, risks such as team issues, funding problems, failure to deliver on promised milestones, or a lack of community engagement cannot be fully assessed. These factors can significantly undermine a project’s long-term viability and price.

Market Manipulation and Liquidity: Smaller market cap cryptocurrencies can be more susceptible to large price swings due to lower liquidity and potential manipulation by large holders (“whales”).

Therefore, investors should approach Vaulta, and indeed any cryptocurrency, with a robust risk management strategy. This includes investing only what one can afford to lose, diversifying portfolios, and conducting thorough due diligence beyond algorithmic predictions. The dynamic nature of the crypto market demands continuous vigilance and adaptability.

Conclusion

The price forecast for Vaulta, as generated by the QuantumCast algorithm, paints an optimistic picture of its potential trajectory over the next decade. While the short-term outlook suggests a period of consolidation and moderate fluctuations, the long-term projections indicate a consistent and significant appreciation, with Vaulta potentially crossing the 1.00 USD threshold within the next eight years. This indicates that Vaulta could emerge as a valuable long-term asset within a diversified cryptocurrency portfolio, benefiting from broader market growth and its own (implied) intrinsic developments.

However, it is paramount to reiterate that these are sophisticated algorithmic predictions based on current and historical data, and the cryptocurrency market remains inherently volatile and unpredictable. Numerous external factors, including evolving regulations, global macroeconomic conditions, and unexpected technological shifts, can significantly influence actual price movements. Therefore, while these insights provide a valuable data-driven perspective, they should be considered alongside thorough personal research and a clear understanding of the risks involved. Investors are strongly advised to exercise caution and make informed decisions based on their individual financial circumstances and risk tolerance.

Disclaimer: We are not responsible for the accuracy of these price forecasts, as they are based on data generated by a proprietary forecasting algorithm. Cryptocurrency investments are highly volatile and speculative, and past performance is not indicative of future results. Investors should conduct their own research and consult with a financial advisor before making any investment decisions.

Senior Crypto Correspondent with over 8 years of experience covering Bitcoin, altcoins, and blockchain technology for leading financial publications. Alexander holds a master’s degree in Financial Economics and specializes in in-depth market analysis, regulatory updates, and interviews with top industry figures.